Heading off on a trip anytime soon and looking for the right travel medical coverage? Let’s talk about SafetyWing Nomad Insurance!

Looking back at my early travel days, it’s funny to think how my travels have evolved over time. Not even 10 years ago, I never thought about travel medical insurance for my trips, I was more focused on making the most of my limited holidays while not going over budget.

But the more traveling I’ve done, the more I understand how easily things can go wrong! I’ve come to realize how much less anxious I am, knowing that I have something to protect me in case any unexpected situations get in the way.

But, at the same time, my budget has always been pretty limited, and I’m still not at a point where I would splurge on insurance, which explains why I’ve traveled without it for so long. But you don’t have to choose peace of mind OR budget – you can have both!

Enter SafetyWing! This review dives into what their policy offers and why it stood out to me as a budget-friendly option. Plus, I’ll share my personal experiences using SafetyWing during my own travels—what’s worked, what hasn’t, and why I continue to rely on it today.

YOU MIGHT ALSO LIKE (if you’re an anxious traveler): Organizing Trips: A Travel Planner’s Tools and Tips

*Disclosure: This article contains affiliate links. If you make a purchase after clicking one of these links, I earn a small commission at no extra cost to you.

SafetyWing Insurance Review: Overview

- 📋 SafetyWing Nomad Insurance: Summary

- ⚖️ SafetyWing Nomad Insurance: Essential Plan vs the Complete Plan

- ✨ SafetyWing Nomad Insurance: My Experience

SafetyWing Nomad Insurance: Summary

UPDATE: SafetyWing just updated their policy in December 2024, this article includes all recent changes!

SafetyWing Nomad Insurance works a little differently compared to other insurance policies. For starters, I was drawn to them because they are quite affordable, made with budget travelers in mind (they even have a 0$ deductible!!). But beyond affordability, what I love most is how flexible their coverage plans are. You can start a policy even after you’ve left for your trip on a monthly subscription, or even upgrade to at-home coverage!

The reason behind their flexibility and affordability is because their insurance was made with digital nomads in mind. Its made for people who work and travel abroad who need an insurance policy that can adapt to their lifestyle. As a result, they have developed a subscription-based policy, available for 180 countries, that now has even more upgrade options (more on that below).

YOU MIGHT ALSO LIKE: Essential Trip Planning Resources You Need to Know

SafetyWing Nomad Insurance: Essential Plan vs the Complete Plan

As of December 2024, SafetyWing Nomad Insurance now offers even more flexiblity! They have introduced new tiers, the Essential Plan and the Complete Plan. Now, what is the difference between the two plans? Let’s break it down below!

The Essential Plan

The SafetyWing Nomad Insurance Essential Plan is the plan I’ve been using for my most recent travels. This plan covers any unexpected emergency expenses while you’re traveling, with limited at-home coverage.

As I mentioned above, SafetyWing offers monthly subscription plans. However, you don’t even need a monthly, recurring subscription if you’re just looking for coverage during specific travel dates. It’s straightforward, and they really have all types of travelers in mind—something I’ve appreciated every time I’ve used it on my own trips (more on that below!).

And don’t let the “nomad” in Nomad Insurance make you think it’s only for full-time travelers or the nomadic lifestyle. The Essential Plan can be used for any holiday 3 days or longer! Anyone can use it as long as the destinations they are traveling to are included in their list of covered countries.

What’s covered?

As any qualified adult would do, the first thing I did was have my mom look at what was covered under SafetyWing Nomad Essential Insurance Plan. As someone who didn’t think much about travel medical insurance until recent years, I wasn’t entirely sure what to look for in a policy. She gave SafetyWing the Mom stamp of approval; in her eyes, any coverage is good coverage! And SafetyWing has some pretty thorough coverage!

Just a quick reminder: SafetyWing provides travel medical insurance, so their coverage is broken down into two main categories. Here’s a quick look at what’s included:

They also have add-ons that include:

🤿 Adventure sports (such as injuries from scuba diving, sky diving, whitewater rafting and more)

💻 Electronics theft (stolen or lost personal items such as cameras, laptops or tablets)

🇺🇸 US coverage (for travel to the US and US territories)

What is not covered?

As with any insurance, not everything under the sun is covered. The SafetyWing Nomad Insurance Essential Plan is there to cover you in emergencies and help with unexpected costs while you’re traveling. If you are looking for long term comprehensive coverage, upgrade to the Complete Plan (we’ll go over this in the next section).

Here is a quick summary of what is NOT included with SafetyWing Nomad Insurance Essential Plan:

🤕 Pre-existing diseases or injury

❌ Cancer treatments

👩🏼⚕️ Non-medically necessary treatments (think cosmetic procedures)

🩺 Routine check-ups, vision, dental, or maternity care

🏠 Limited at-home coverage

To keep in mind: this is just a quick summary of their policy. You should review their full policy and list of inclusions and exclusions before purchasing! You can find their complete policy online.

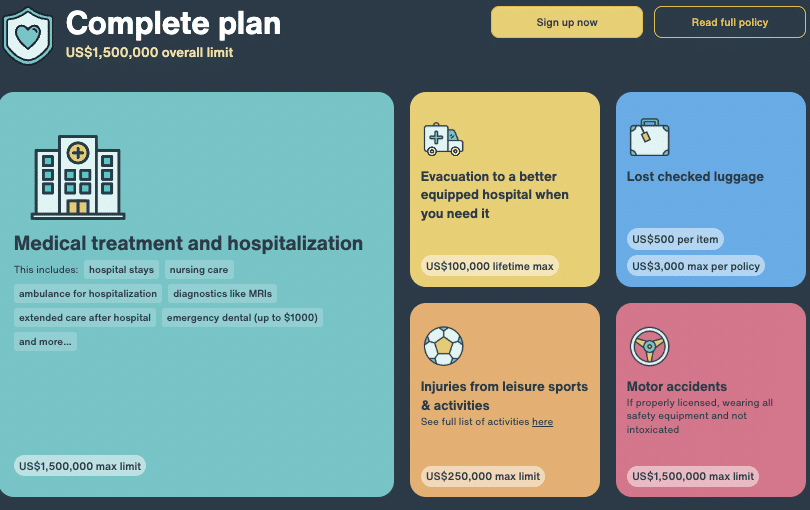

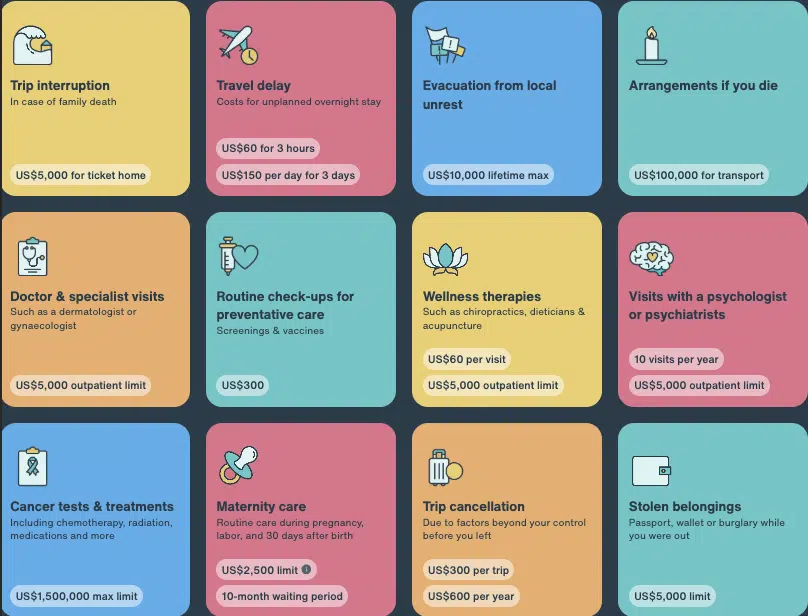

The Complete Plan

The SafetyWing Nomad Insurance Complete Plan now includes comprehensive at-home coverage. With this plan, you have no limitations to your at-home coverage – in fact, this policy works as a long term medical insurance. Its now easier to find coverage that best suits your needs.

The Complete Plan is designed for long-term nomads and travelers and includes comprehensive coverage not included in the Essential Plan, such as maternity care, cancer treatments, and routine healthcare. While the Essential Plan is meant to cover medical emergencies, the Complete Plan is global health insurance.

A minimum contract of 12 months is required when you subscribe that can be paid in monthly or yearly instalments.

What’s covered?

The main difference between the two policies is that the Complete plan is intended to act as your comprehensive at-home health care insurance with additional travel benefits. This means you’ll be covered no matter where you are in the world – whether you’ve settled somewhere or are still on the road! You’ll enjoy the same coverage as the Essential Plan, with additional long-term coverage including:

✅ Adventure sport coverage (already included, add-on not necessary!)

✅ Cancer treatments and screening

✅ Mental health support

✅ Maternity care

✅ Routine check ups

✅ Doctor and specialist visits (such as dermatologist, gynaecologist or chiropractics)

What is not covered?

The Complete Plan still does not cover pre-existing conditions from before the plan is activated. This includes a prior diagnosis, treatment, or symptoms within two years prior to the start date.

At the time of writing this, electronics theft is not included in the Nomad Insurance Complete Plan, however, it is coming soon!

SafetyWing Nomad Insurance: My Experience

For context, I used SafetyWing Nomad Insurance Essential Plan on my 2-week trip to Morocco in November 2023. This was a new country (and continent!) for me and we had quite a range of activities planned for our trip. I hadn’t heard from friends or family of anyone having major problems while visiting in Morocco, but one thing that kept coming up was the possibility of getting sick. Now, everyone is different but to be safe rather than sorry we opted for insurance!

How does it work

I bought my coverage before the trip, but my fiancé signed up after we’d already arrived in Morocco. I was genuinely impressed about how easy and user-friendly it was to navigate their site. All of the information was clear, easy to find and I really appreciated the transparency.

Since I knew my travel dates and didn’t want to opt for the subscription model, I inputted my dates and the country I was visiting. And the moved on to payment! It was surprisingly hassle-free!

READ MORE: SafetyWing Nomad Insurance

Pricing

On the SafetyWing Nomad Insurance page (or in the space above), you can quickly get an estimate of your coverage costs. Again, it was super easy to use! The cost of your insurance will vary depending on your age, the length of your trip, and if you opt for any add-ons.

For my 2-week trip to Morocco in 2023, it cost me $32.02 CAD (the prices have slightly increased since, refer to their calculator for updated estimates). It was really a small price to pay to make me feel so much more secure and confident while traveling. Luckily for me, I did not need to use their insurance on my trip!

Pros & Cons of the Essential Plan

Pros

✅ Simplicity: I’ve said it a few times, but I’ll say it again: it was really easy and clear to get set up my insurance policy. Everything felt super transparent and clear to understand – which is something I appreciate as a newbie and anxious traveler!

📆 Flexibility: you don’t need to have an end date for your travels when you subscribe. You can renew your subscription on a monthly basis, plus you can already be traveling when you sign up for their insurance. Basically – they’re very flexible! And now with the Complete Plan, you have even more options to find coverage that best suits your needs!

💰 Affordability: As I said above, SafetyWing was a very affordable option that left me feeling more covered and protected. Of course, there are more expensive, thorough plans out there, but I found SafetyWing to be very cost-effective for what I needed.

🗺️ Home country coverage: This is a very new and rare option to find with travel insurance! It’s great for nomadic travelers who might need to pop home every now and then! For every 90 days, you have 30 days of coverage in your home country with the Essential Plan and even more comprhensive coverage with the Complete Plan!

🩺 Coverage: I found that what is covered under SafetyWing Nomad Insurance Essential Plan to be quite thorough, specifically for medical emergencies such as hospital, doctor visits, and some eligible prescription drug expenses. Of course, the Complete Plan offers even more comprehensive coverage if thats what you’re looking for!

🎉 0$ deductible: You’re covered right from the get-go and don’t need to pay anything before making a claim – how relieving is that!!

Cons

❌ Age limit: You are not covered if you are over the age of 70.

📸 Limited coverage unless you opt for the add-on: Without the electronics and extreme sports add-on, there are some limitations to what is covered. Just make sure that if you’re traveling with expensive gear or have adventure activities planned to include the add-on when you purchase your policy – I’ve done this for my past few trips!

❤️🩹 Pre-existing conditions aren’t covered: In both plans, if you have any serious pre-existing conditions that may need medical attention while traveling, do keep in mind that this will not be covered as part of your policy.

Final Thoughts on SafetyWing Nomad Insurance

When it comes to travel medical insurance, I’d say SafetyWing has far more positives than negatives. I’ll admit, I haven’t had to file a claim, so I can’t fully speak to that aspect of the experience. But everything I have experienced with SafetyWing has been fantastic! From their $0 deductible to the flexibility and user-friendly experience, I think this insurance is great for all types of travelers.

YOU MIGHT ALSO LIKE: Travel Planning 101: How to plan your next adventure

As someone who went a long time without insuring myself on trips, I can honestly say that having SafetyWing in my corner has helped me travel with much more confidence. Whether you’re planning a weekend getaway or a longer adventure, SafetyWing’s unique features make it worth considering for peace of mind during your travels.

Did you know? If you are a travel blogger and are interested in becoming a SafetyWing ambassador, click here to learn more!

2 Responses

Hey Caity,

I’m looking to sign up for the Nomad Insurance.

Do I have to pay the medical bills upfront, and where can I find a list of the bigger hospitals that work directly with SafetyWing?

Kind regards,

Leo

Hi Leo! So sorry for the late reply! So SafetyWing explains that payment works depending on the claim. Generally, any outpatient treatment would be on a pay-and-claim basis, and for inpatient treatment, the Hospital can contact SafetyWing and set up a GOP (guarantee of payment) – this is usually for large bills. It’s the hospitals who decide whether they will accept a guarantee of payment from SafetyWing. And in terms of a list of hospitals, SafetyWing doesn’t restrict members on what hospital they can visit. Hopefully, that answers your question! 🙂