London has a reputation for being quite expensive and if you’re new to the city, you’ll learn that doing a flat share is a very common way to save money. But when I was planning my move, I wasn’t quite sure if it was the best fit for me. So, what is it exactly?

Flat sharing is when you rent one room in an apartment and you have roommates occupying the other bedrooms. You all share the common rooms like the kitchen and bathrooms.

Renting an apartment is when you, by yourself or with a friend of your choosing, rent an entire apartment – no sharing required (I mean unless you choose to have a roommate).

Lucky for you, I tried both. I rented for a year with a friend and I flat-shared with 4 different roommates for a year. Here, you’ll find an outline for you my personal experience and why I didn’t jump straight into flat sharing. I’ll also share with you my budget from each living situation. Finally, I will go over my opinion in terms of the pros and cons of each option.

My Experience

How did I find a place to live when I first arrived?

When I moved to London in September 2019, I went over with a teaching agency. I was also moving over with a friend – so we had every intention to find a place to live together.

The plan was to arrive in London 2 weeks before starting work (with my mommy by my side) and have apartment viewings already arranged for when we landed. We wanted to use those 2 weeks to find a place to live and get set up with a bank account, phone plan and all of that other important stuff. We rented an Airbnb in the meantime while we were getting settled.

Before I even left Canada, I spent hours looking at apartment listings on Rightmove and Zoopla. But if I’m being honest, it got me NOWHERE. All of the listings were outdated or no longer available. I was contacted by the different rental agencies detailing what was available. They also asked if we could come by today or if they could call me to discuss my needs further. Of course, I couldn’t really do that while still in Canada.

It was disappointing because I wanted to have the process well underway before arriving. But unfortunately, we just had to wait until we were there in person. Getting on the plane with nothing ready for you when you land is a pretty daunting feeling. Those 2 weeks were spent visiting agencies, and stopping by different apartments. After a week to a week and a half, we settled on one.

In hindsight, 2 weeks is a relatively short amount of time to get your whole life set up from scratch. We ended up staying in the Airbnb a bit longer before we were allowed to move in. It was quite overwhelming, so maybe give yourself more time to avoid any unnecessary stress.

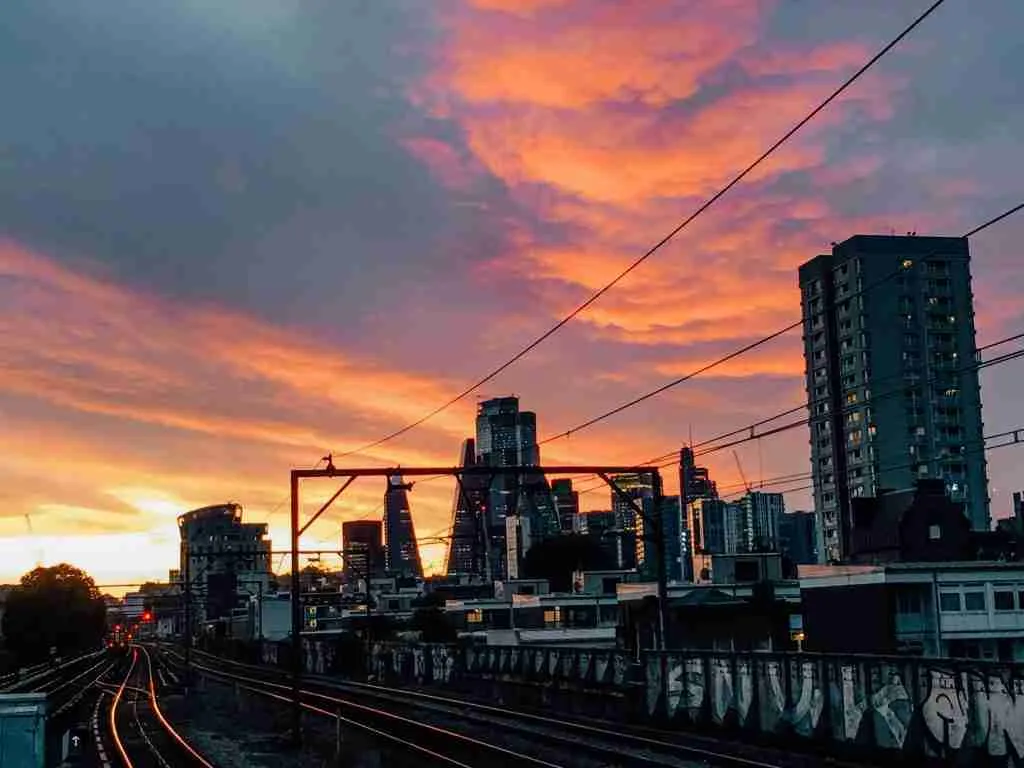

In the end, we rented an apartment in South London (that was the area that we felt most comfortable in) and signed a 1-year lease.

Why did I hesitate at first to flat share in London?

You might be thinking, why were we only looking for apartments when we first arrived? Why not a flat share?

In all honesty, there was fear involved. We were moving to the other side of the ocean by ourselves for the first time, in a new city and with new jobs. Almost every element of our lives was new and changing. We both felt that on top of all of that, living with people we don’t know was going to be a bit too much for us to handle.

We pondered the pros and cons of the idea (based on our assumptions of flat sharing) and felt that the comfort of having our own space in a brand-new city was worth it.

Could we afford to live in an apartment with our salaries?

After signing our lease, I informed our teaching agency. They were very concerned that we would not be able to afford to live in an apartment with our salaries. By this point it was too late, we had already signed the lease and were stuck for the first year.

Panic mode set in. I remember it vividly: we were sitting in a Costa Cafe (because we needed the wifi) scrambling trying to figure out how to get out of our lease. My friend anxiously rubbed her temples and delved into researching the options, while I sat there useless spiralling out of control. My mom took over and we went into budget mode.

Was the agency right? Did we REALLY need to move out? No!

Did we have enough to make rent and buy food? Yes, we were perfectly comfortable.

Now let’s take a look at what my budget looked like after this incredibly stressful afternoon in Costa.

Disclaimer: I lived in London during Covid – which of course impacted my budget and spending. However, when it was allowed, I still travelled around the country extensively, I visited museums, saw shows, tried restaurants, did day trips and commuted to work most days. So in the end, I still had a relatively normal experience for a good part of my time in London.

My budget for the apartment

Whenever I am building a budget, I always start with the essential expenses. What do I need to pay for in order to survive?

In the apartment, this was my portion of our essential expenses PER MONTH :

🏠 Rent: 775 £

💰 Council Tax: 67 £ (this is like a property tax, each borough pays a different amount so you’ll need to look into it for your area)

⚡️Utilities: 55£ (this includes water and electricity)

💻 Wifi: 12 £

These were my personal essential expenses that I did not share with my roommate PER MONTH:

📱Phone: 54£ (this is an extremely high rate for the UK and it is because I bought a new phone when I arrived so my monthly payments included me paying off the phone)

🚊 Transit: 160£ (I had to travel all around the city for supply teaching, which meant I was riding around many different zones per week – so I had a higher transit budget)

🛒 Groceries: 160£ (I anticipated spending around 40£ on groceries for myself per week, I did not spend this every week but this was my estimate for building my budget)

After the first month or two, I started to get a more accurate sense of my earnings and expenses. In the end, I had money left over after my essential expenses which meant I could add a new category to my budget.

This was my non-essential budget for the first few months of living in London PER MONTH:

🛟 Emergency Savings: 115£ (this was something my mom strongly recommended because I was supply teaching and with that means there was variability in when/if I was working)

✈️ Travel: 50£ (for the first few months this meant day trips out of the city such as to Oxford)

🍿 Personal: 50£ (this was for if we went out for food or to a movie or show – all the fun stuff!)

Of course, these numbers were an estimate I gave myself. I also used a template to track my expenses to make sure I was staying on track and to give me a sense of where I was in terms of my monthly spending. I also had to adjust my budget depending on the month because as a supply teacher, you don’t get paid during the holidays. So during months when I would be working 2 weeks instead of 4, I had to adjust my non-essential spending and/or rely on savings.

We kept with the plan and moved out of the apartment in September 2020 to spend our last year in a flat share – hoping to save money. We found our flat share through the site Spareroom.

My budget for the flat share

We stayed in South London but moved to a new borough. Because I was now in a flat share, I did not need to split any expenses with my friend anymore. We each paid our portion directly to the landlord. The house had 5 bedrooms so my friend and I had 3 new roommates.

I was also no longer supply teaching due to Covid. In March 2020, I was hired full-time as a teacher at a school I had been working at. This meant that my salary went up by around 200£ per month.

Here were my essential expenses in the flat share PER MONTH:

🏠 Rent: 600£ (my rent also included: Council Tax, Utilities & Wifi)

📱Phone: 54£

🛒 Groceries: 160£

🚊 Transit: 160£ (even though I was working at a school full time and took the same train every day, due to Covid it was hard to accurately anticipate my budget for transit)

Because I was earning and saving just a little more, I had extra money to work with – which was great!

My non-essential budget now included travel savings as well as emergency savings, more to spend for travel and personal expenses, a small clothing budget and even a personal care budget (hair/face products, hair cut etc).

Pros vs Cons – What people don’t tell you!!

It is obvious that even if my salary didn’t change, flat sharing did, in fact, save me money. But budget aside, what were the other differences between flat sharing and renting an apartment? Let’s get to the nitty gritty details to really compare the two.

Living in an Apartment: Pros

✅ You have complete control over whom you live with: this was important to us in the first year as I mentioned above. We didn’t want to take any risks in terms of adding extra roommates.

✅ You also have control over the entire apartment, not just one room: again when we moved to a new city, this is something we felt we needed to help us adjust!

✅ It feels more like home: since you have this control, it is completely your place!

Living in an apartment: Cons

❌ More expensive: naturally you are living with fewer people so you are paying more for rent.

❌ You have to register, install and take care of your utilities and council tax yourself: this was a BIG con for us. We had to take care of all of our own bills, get them set up and installed and everything else that goes along with it. It isn’t the worst thing but it really was annoying to take care of it. It’s also an extra expense to factor in!

❌ Leases are typically 1 year – less flexibility: we were finding most leases were a year or even 2 went looking into renting. So in our situation, we were stuck for an entire year even if we wanted to move.

❌ We had to buy some furniture: our apartment was furnished with the basics (bed, couch, fridge, drawers, table) but we had to go to Ikea to buy basic items like lamps, bedside tables, mirrors etc. In the end, it was cheap but still wasn’t ideal. We also had to deal with the furniture we bought when we decided to leave (either sell it, bring it or get rid of it).

❌ Had to wait until we were in London before starting to apartment hunt: like I said above, I tried to apartment hunt before coming to London but it wasn’t effective at all. Most of our research had to wait until we were in the city with an operating phone!

Living in a flat share: Pros

One thing about flat shares is that it REALLY varies place to place. You can luck out and have great roommates and a great, clean, spacious apartment or you can have noisy, dirty roommates. The same goes for the landlord and the building itself. It really all depends. This is another reason why when we first arrived, we wanted to play it safe and not have to deal with the risk!

✅ You have the chance to meet new people: if you’re lucky, you can have some pretty cool people as roommates! Most people like flat sharing because it is a chance to meet new people – especially if you’re alone or new to a city.

✅ Very minimal responsibilities: typically your utilities, wifi and council tax are included in your rent and you don’t have to deal with it at all! Your main responsibilities are keeping the common spaces clean for your roommates. For us, a cleaning schedule was organized amongst the roommates.

✅ Leases are much shorter: leases for flat shares can be as short as 3 months so they are much more flexible. You don’t feel like you’re tied down anywhere.

✅ Comes with furniture: our flat share was completely furnished and the landlord’s representative actually came by once or twice and added some furniture to my room (an extra side table).

✅ Can choose where you want to live before you arrive in London: when we were getting new roommates in the flat share, some of them had signed on before they even arrived in London. The listings posted on Spareroom were much more recent and up to date so you can find something before you even arrive (unless you want to see it in person first of course).

Living in a flat share: Cons

❌ Very minimal control over common spaces: this is what happens when you have roommates. People are messy, not everyone helps with chores, and sometimes people are loud and aren’t considerate of others. It happens, but can, of course, get very frustrating.

❌ My room was much smaller: this makes sense when you’re paying cheaper rent. But it was hard to downsize – not impossible but hard!

❌ If you do not have a good landlord or roommates, it can be challenging: like I said above, it’s risky when you have roommates because you don’t know them in advance. The same is true for landlords. There was a time when our landlord’s representative was over all the time. There were fights at times between roommates or between the landlord and roommate. Of course, this was my personal experience but is sometimes a reality.

❌ You only have your room to yourself: not all houses come with a living room, and unless you get along well with your roommates, you might be spending a lot of time in your bedroom. In the apartment, my room was bigger and I had more space in the entire apartment to spend my time.

❌ High turnover – not best for long-term living: we lived in this 1 flat share for one year. During that time, we had 7 different roommates. Because the leases are shorter, the rooms are smaller and you never know what you’re going to get until you’re there, people can move around quite frequently. So this also meant that throughout the year, there were always people stopping by for viewings. There were times when I felt that the landlord or the representative was at the house daily!

Which should you choose: flat share or apartment rental?

I sadly can’t answer that for you. Living in a new city is an entirely personal decision. What worked best for me might not be what’s best for you.

Generally, flat sharing is cheaper and you have less to worry about (furniture, utilities etc). Whereas in an apartment, you have a lot more control over your place and it feels like YOUR private space. For me, living in an apartment first allowed us to get settled in, and adjust. We could simply come home and just relax in our own space after a stressful day.

Could we have saved more money by living in a flat share for 2 years? For sure! Would we have had less to deal with? Definitely. Do I regret living in an apartment? Not at all!

Even though my budget was tighter, I still was able to explore the city, see some shows, visit museums, go on a day trip and travel (before covid came). I wasn’t broke!

Did I eat in restaurants and shop all the time? Nope, but I didn’t do that when living in a flat share either! Did I track my expenses and live mindfully? All of the time!

It all depends on what is most important to you – that’s the thing with budgeting! After your essential expenses are covered, how do you want to spend your money? How much do you need in order to do that?

I hope this was helpful for you as you are preparing to start your life in London! I hope it gives you an idea of what to expect in terms of your expenses in London! Be sure to take the time to consider these points when deciding on where you want to live!

Want to know more about how to spend the PERFECT day in London? Check out my GO-TO day in London Itinerary on Thatch!

Are you pro apartment or pro flat share? Comment below!

4 Responses

Hi!

I’m contemplating supply teaching in London next school year and trying to budget how much I would take home ever month. I heard it’s about 150 pounds a day but considering the breaks, how much did you take home by average? I’m trying to look at accommodations and see what I swing. Thank you!

Hi!! I am posting an article in a few days about supply teaching in London! So I’ll post the link here when its live! When I was supply teaching (this was about 2 years ago, so potentially it has increased), my daily rate at my agency was 130 pounds. At the time, after taxes and everything I was taking home about 458 pounds a week if I worked every day, full day! There are a lot of school holidays in the UK which is great if you want to travel but it means there are many months out of the year you do not earn 4 weeks of salary so do keep that in mind when building your budget! 🙂

Thank you! I will definitely want to read that article about supply teaching in London. I was thinking the same thing because I know they have more breaks so less days to each supply teaching. I found a studio on airbnb month to month is about 1000 pounds and trying to see if I could afford it with this salary. (it has everything included and is in Ealing close to the underground Zone 3). I think the daily rate went up to 150 pounds now based on the agency I talked to and hoping my 5+ experience would put me up at a higher rate per day too. Can’t wait to hear about supply teaching!

No worries! I just posted the article today! Here is the article! Hopefully it’s helpful for you and if you have other questions, don’t hesitate to ask!